Getting My Ach Payment Solution To Work

Cable transfers are also much more expensive than ACH settlements. While some banks do not charge for wires, in some instances, they can set you back customers approximately $60. EFT repayments (EFT represents digital funds transfer) can be made use of reciprocally with ACH settlements. They both explain the exact same payments mechanism.:-: Pros Price: ACH settlements often tend to be more affordable than cable transfers Rate: faster considering that they do not utilize a "batch" procedure Disadvantages Speed: ACH settlements can take a number of days to process Price: fairly expensive resource: There are two kinds of ACH payments.

ACH credit report purchases allow you "press" money to different financial institutions (either your own or to others). They make use of ACH credit rating deals to press money to their staff members' financial institution accounts at assigned pay periods.

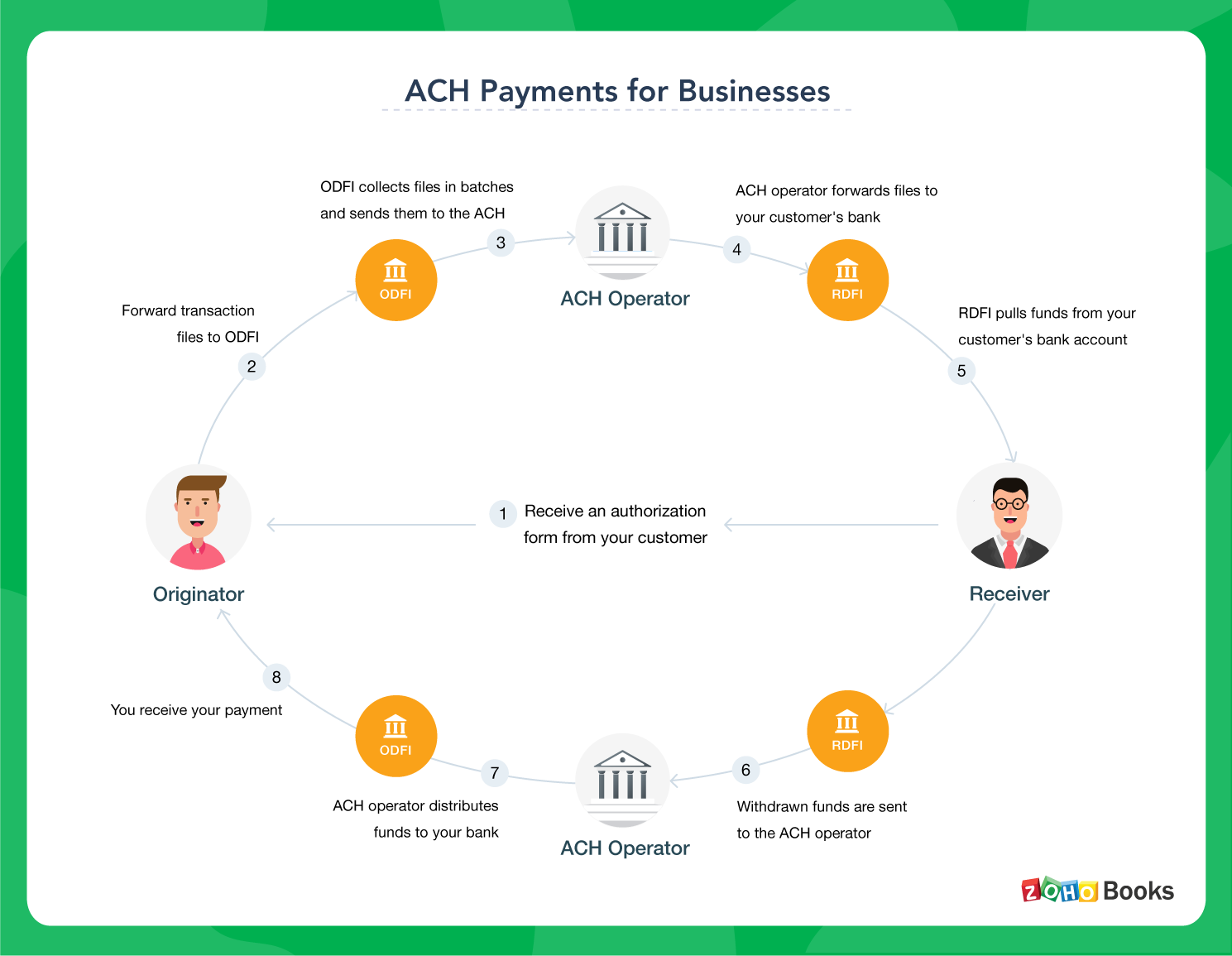

Customers that pay an organization (state, their insurance carrier or home mortgage lender) at particular periods might choose to enroll in repeating repayments. That provides the service the capacity to launch ACH debit purchases at each billing cycle, pulling the amount owed directly from the client's account. In addition to the Automated Clearing House network (which attaches all the financial institutions in the United States), there are three other players associated with ACH payments: The Originating Depository Financial Establishment (ODFI) is the financial organization that launches the deal.

Fascination About Ach Payment Solution

The National Automated Clearing Up Home Organization (NACHA) is the nonpartisan governmental entity accountable for looking after as well as regulating the ACH network (ach payment solution). Allow's take your automated month-to-month phone costs settlements as an instance. When you register for autopay with your telephone company, you give your checking account details (routing as well as account number) as well as authorize a reoccuring repayment consent.

Both banks then connect to make certain that there are enough funds in your savings account to process the purchase. If you have sufficient funds, the deal is refined and the cash is transmitted to your telephone company's checking account. ACH repayments typically take a number of organization days (the days on which banks are open) to experience.

, economic establishments can pick to have actually ACH credit scores refined and provided either within a business day or in one to 2 days. ACH debit purchases, on the other hand, should be processed by the next service day.

The adjustments (which are happening in phases) will certainly make view it feasible widespread use of same-day ACH repayments by March 2018. ACH repayments are normally more budget friendly for companies to process than credit cards.

Ach Payment Solution Fundamentals Explained

:max_bytes(150000):strip_icc()/how-ach-payments-work-315441-v2-5b4cb9f346e0fb005bd7eeae.png)

Some ACH cpus charge a level rate, which commonly varies from $0. 25 to $0. 75 per deal. Others bill a level portion charge, ranging from 0. 5 percent to one percent per purchase. Carriers might likewise charge an added regular monthly charge for ACH settlements, which can vary. Square makes use of ACH repayments for deposits, and also there's no cost related to that for Square vendors.

These deny codes are essential for giving the best info to your customers regarding why their settlement didn't undergo (ach payment solution). Below are the four most common turn down codes: This means the client didn't have enough money in their account to pop over to these guys cover the quantity of the debit access. When you get this code, you're possibly mosting likely to have to rerun the transaction after the customer transfers even more cash into their account or provides a various repayment technique.

It's likely they failed to remember to alert you of the modification. They have to provide you with a new savings account to refine the transaction. This code is set off when some combination of the information offered (the account number and name on the account) doesn't match the financial institution's records or a missing account number was entered.

If a financial institution does not allow an organization to withdraw funds from Get the facts a particular savings account, you'll obtain this turn down code. In this situation, the consumer needs to supply their financial institution with your ACH Mastermind ID to allow ACH withdrawals by your business. After that you require to rerun the deal. Sadly, denied ACH payments might land your organization a fine cost.

What Does Ach Payment Solution Do?

To stay clear of the inconvenience of disentangling ACH turns down, it may be worth just approving ACH payments from relied on clients. Although the ACH network is taken care of by the federal government and also NACHA, ACH repayments do not need to follow the same PCI-compliance standards required for charge card handling. Nonetheless, NACHA calls for that all events associated with ACH transactions (including organizations initiating the payments and third-party processors) apply processes, treatments, as well as controls to safeguard sensitive information.

That suggests you can't send or receive financial institution info via unencrypted email or insecure web types. Make certain that if you use a 3rd celebration for ACH repayment processing, it has executed systems with state-of-the-art encryption methods. Under the NACHA rules, originators of ACH payments have to also take "readily affordable" actions to ensure the credibility of consumer identity as well as directing numbers, and also to recognize feasible deceptive activity.

Comments on “The Facts About Ach Payment Solution Uncovered”